As a bank teller, you’re a trusted individual that handles large sums of cash.

In fact, you’re the face of the bank!

You’ll be faced with many problems during your shifts, but perhaps you didn’t expect to face one so soon...

Your resume!

What does a good bank teller resume look like, anyway?

With so many people competing for the best bank teller positions, you can’t leave any questions unanswered.

But don’t worry, this guide has you covered!

- A job-winning bank teller resume example

- How to create a bank teller resume that hiring managers love

- Specific tips and tricks for the banking industry

Here’s a bank teller resume example, built with our own resume builder:

Looking for a resume example for a different finance position? We've got more resume examples right here:

- Banking Resume

- Financial Analyst Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- MBA Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

Follow the steps below to create a bank teller resume of your own.

How to Format a Bank Teller Resume

Banking is always going to be a competitive segment of the job market.

However, you may be surprised at just how many apply for the position of bank teller.

Now, we aren’t telling you this to scare you.

Rather, that you must do everything in your power to make your resume stand out.

The first course of action is to choose the correct format.

You see, even those with the richest of bank teller experience won’t be able to impress a hiring manager that is struggling to read the content.

The “reverse-chronological” format is the most popular format for bank tellers, and it’s for good reason. It displays your most recent work experience first, and then works backwards through your history and skills.

You could also try the two following formats:

- Functional Resume - This format places a large emphasis on your skills, which makes it the best format for bank tellers that are highly-skilled, but have little in the way of bank teller work experience.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, which means it focuses on both your banking skills AND work experience.

- Try to keep your bank teller resume to one-page. Doing this will show the hiring manager that you present information is a precise way. Feel free to check out our one-page resume templates.

Once the format is sorted, you need to choose the correct resume layout.

We recommend the following layout:

- Margins - One-inch margins on all sides

- Font - Pick a font that stands out, but make it professional

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Line Spacing - Use only 1.0 or 1.15 line spacing

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates.

- As a bank teller, the recruiter wants to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Bank Teller Resume Template

Ever made a resume?

If so, there’s a good chance that Word was the program of choice.

There’s also a good chance that your resume wasn’t as well-formatted as it could be.

It’s no secret that Word is far from the best tool for the job.

For a professional bank teller resume that has a solid structure, you may want to use a resume template.

What to Include in a Bank Teller Resume

The main sections in a bank teller resume are:

- Contact Information

- Work Experience

- Education

- Skills

For a bank teller resume that stands out from other applications, add these optional sections:

- Awards & Certification

- Languages

- Interests & Hobbies

Right, now let’s talk about each of the above sections, and explain how to write each of them.

For even more information, check out our guide on What to Put on a Resume.

How to Write Your Contact Information Section

As a bank teller, you should know that not a single digit can be out of place.

And this is exactly the case with your contact information section. One small misspelling of your phone number can render your whole application useless.

For your contact information section, include:

- Full Name

- Title - This should be specific to the exact job you’re applying for, which is “Bank Teller”

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address (firstname.lastname@gmail.com), NOT that email you created back in school emilylovespizza@gmail.com)

- (Optional) Location - Applying for a job abroad? Mention your location

- Emily Hembrow - Bank Teller. 101-358-6095. ehembrow@gmail.com

- Emily Hembrow - Banking Admin Angel. 101-358-6095. emilytheorange@gmail.com

How to Write a Bank Teller Resume Summary or Objective

Now, you should be aware that making your resume stand out is the #1 goal.

But HOW can you do this?

There’s no use putting your best achievements right at bottom of the resume.

Nope – you need an opening paragraph that you can bank on!

These opening paragraphs are known as either a resume summary or objective.

Both are short, snappy paragraphs that sum up the main points of your resume. They are great for introducing your skills and experiences.

The difference between a summary and objective is that.

A resume summary is a paragraph that summarizes your most notable experiences and achievements. It is the best option for individuals who have multiple years of bank experience.

- Committed bank teller with five years of experience at YZX Bank, where I balanced ledgers, handled cashed, maintained accounts, and more. Maintained a 99.80% customer satisfaction rating during the total period of employment. Seeking a chance to leverage my interpersonal skills and banking knowledge to become a bank teller at Bank XYZ.

On the other hand, a resume objective should give a run-down of your professional goals and aspirations. It is ideal for entry-level bank teller candidates. Although you’re talking about your own goals, it is important to align these goals with the employer’s vision.

- Motivated finance student looking for a bank teller role at Bank XYZ. Two years of experience at a gym reception with heavy traffic. Excellent communication, organization, and problem solving skills. Enthusiastic to support your client-facing staff, where I can use my interpersonal skills to achieve the best quality of service.

So, which one is best for bank tellers?

Well, a summary is suited for bank tellers with work experience, whereas an objective is suited for those who are entering the field for the first time (student, graduate, or switching careers).

How to Make Your Bank Teller Work Experience Stand Out

There’s no easier way to impress the hiring manager than with a rich work experience.

Sure, talking about your education and banking knowledge is super important, but nothing proves your talents like a wealth of bank teller experience.

Follow this layout in your experience section:

- Position name

- Company Name

- Dates

- Responsibilities & Achievements

Bank Teller

XYZ Bank

01/2018 - 03/2020

- Voted “Teller of the Year” in 2018 and 2019

- Set-up a new database system that accurately secured all transactions

- Processed withdrawals, deposits, transfers, loan payments, and cashier’s checks for 50+ people every day]

To make your experience stand out, you should focus on your most impressive achievements, rather than your daily responsibilities.

Instead of saying:

“Data entry”

Go for:

“Set-up a new database system that accurately secured all transactions”

So, what exactly are we suggesting here?

Simply put, the first statement isn’t impressive – at all!

On the other hand, the second statement goes into more detail and shows that you’re an excellent asset to the bank.

- Tailor your experience to the job advertisement. Simply look for any required skills that you can demonstrate in your work experience.

What if You Don’t Have Work Experience?

Maybe you’re a finance graduate who hasn’t worked before?

Or maybe you’re transitioning from a different banking position?

Whatever the situation, don’t threat.

You see, it doesn’t matter if you haven’t been a bank teller in the past, as you can still add relevant skills and experiences from previous jobs.

For example, if you’ve worked store manager, you can talk about any crossover skills and experiences. Just like a bank teller, you would have to be friendly, give advice to customers, and help with cashier duties.

For the students read this, you’ll enjoy our guide on how to make a student resume!

Use Action Words to Make Your Bank Teller Resume POP!

- “Responsible for”

- “Worked with”

- “Created”

You’ll find these same words on nearly all bank teller resumes.

And since you need your bank teller resume stand out, we’d recommend using some of these action words instead:

- Designed

- Introduced

- Initiated

- Devised

- Launched

- Determined

- Drafted

- Formulated

- Launched

- Originated

- Conceptualized

- Spearheaded

How to List Your Education Correctly

The next section in any bank teller resume is the education section.

Now, there isn’t just one correct path to becoming a professional bank teller.

In fact, a high school diploma or GED certificate is usually all that’s required.

So whatever path you have taken, just include the following details:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Boston State University

2016-2020

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Risk Analysis, Financial Management, Bank Lending and the Legal Environment, Quantitative Methods for Banking, Finance and Economics, and more]

- GPA: 3.8

Now, you may have a few questions, so here are the most frequently asked questions:

- What if I haven’t finished studying?

No problem. Regardless of whether you’re still studying or not, you should still mention all of the years that you have studied to date

- Should I include my high school education?

Only if you don’t have any higher education. The bank manager will have little care for your high school education if you have a finance degree

- What is more important for a bank teller, education or experience?

If you’re an experienced bank teller, your work experience should come before your education

If you still have questions, you can check out our guide on how to list education on a resume.

Top 15 Skills for a Bank Teller Resume

Being a professional bank teller requires having a certain set of skills.

And the hiring manager needs to see that you have them!

Now, you may be the most skilled bank teller in the world, but you need to make these skills clearly displayed on your resume.

You see, the manager can’t see your skills if you hide them away in a bank vault!

Here are some of the skills a hiring manager wants to see from a bank teller...

Hard Skills:

- Balancing Ledgers

- Mortgages and Loans

- Deposits and Withdrawals

- Investments

- Safety Deposit Boxes

- Cash Handling

- Risk Assessment

- Account Maintenance

- Foreign Currency Exchange

Soft Skills:

- Excellent Communicator

- Teamwork

- Time Management

- Problem Solving

- Confident & Professional Manner

- Organization

- Although soft skills are important for a bank teller, they’re difficult to prove on your resume. As such, try not to go too overboard with the generic soft skills. You should also think of situations that you have used your soft skills, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills.

Other Resume Sections You Can Include

By now, you should have fantastic-looking resume that highlights your array of skills and experiences!

But wait...

Is your resume the absolute best it can be?

Remember, the #1 goal is for your resume to stand out.

And a carbon copy of your competitors resume is not going to do that.

The following sections will set you apart from the other bank teller candidates.

Awards & Certifications

Did you win any recognition awards at your previous work place?

Did you win a competition during your studies?

Have you completed any relevant courses on Coursera?

Whatever the recognition, be sure to add any awards and certifications to your resume.

Awards & Certificates

- “Economics of Money and Banking” - Coursera Certificate

- “Learning How to Learn” - Coursera Certificate

- “Teller of the Year” 2018 and 2019 - XYZ Bank]

Languages

Whether or not the bank teller requires knowledge of another language, being able to speak multiple languages is an impressive skill.

If you can speak any other language, even to a basic standard, feel free to add it to your resume, but only if you have space.

Order the languages by proficiency:

- Native

- Fluent

- Proficient

- Intermediate

- Basic

Interests & Hobbies

Now, you’re likely wondering, “why does the hiring manager need to know about my book club meeting every Friday?”

Well, they don’t need to know, but it allows the hiring manager to learn more about you as a person.

And this is a good thing, as banks are looking for someone who they’ll get along with.

The best way to do this is by listing your hobbies and interests!

Especially if your hobby involves social interaction, as you’ll be working in a customer-facing role.

If you want some ideas of hobbies & interests to put on your resume, we have a guide for that!

Match Your Cover Letter with Your Resume

According to the U.S. BLS, bank teller jobs will decline by 12% between 2018 and 2028.

And this means there will be a constant increase in competition for the top jobs.

As such, you need to do everything in your power to stand out.

But HOW can you do this?

Well, by writing a convincing cover letter!

You see, a letter is perfect for communicating with more depth and personality.

Even better, you can show the bank’s hiring manager that want THIS position in THIS bank.

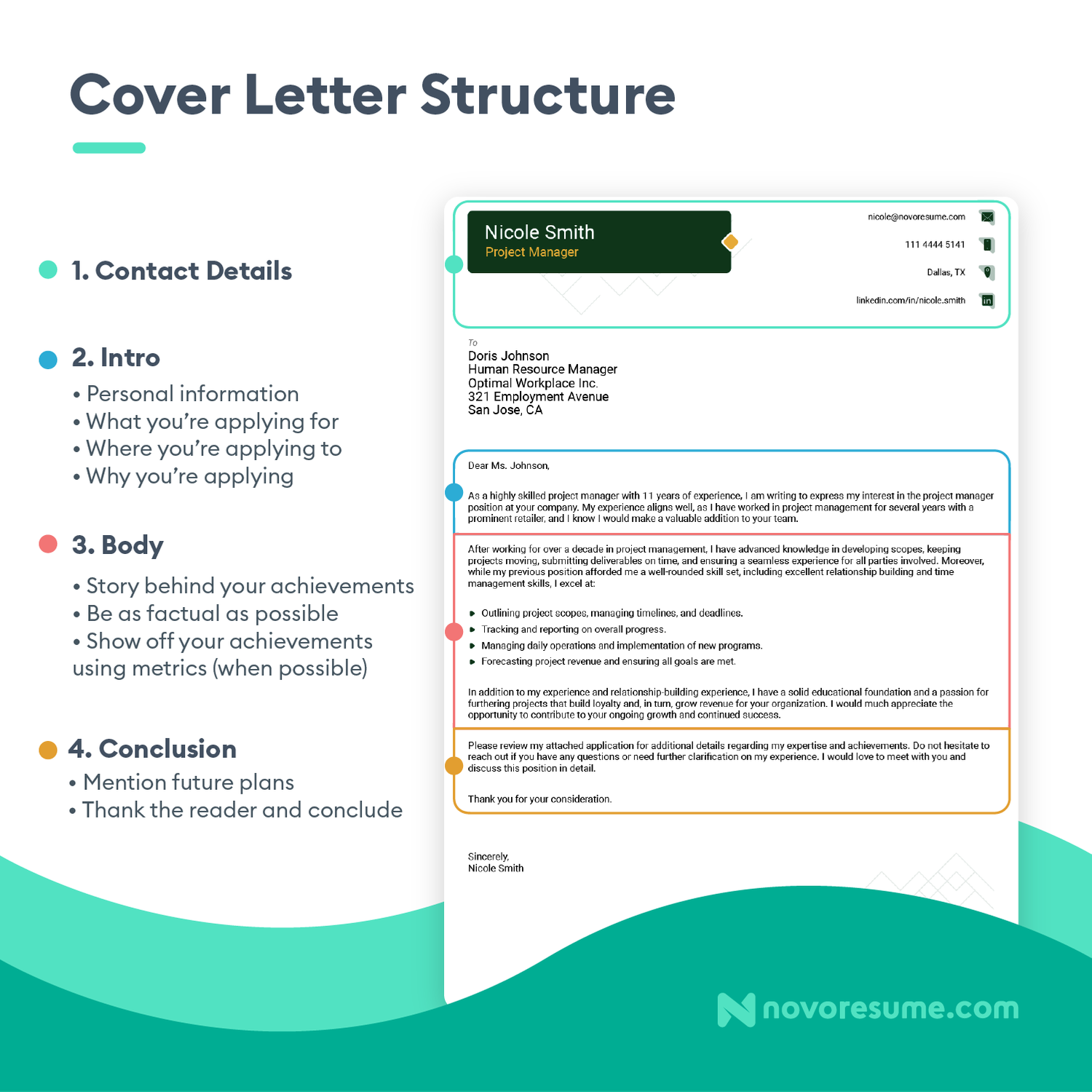

As with your resume, your cover letter should also have the correct structure.

Here’s how to do that:

And here’s what to put in each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website (or Behance / Dribble)

Hiring Manager’s Contact Information

Including full name, position, location, email

Opening Paragraph

It’s critical to hook the hiring manager with your opening paragraph, so it needs to be very powerful, otherwise they’re not going to read the rest of your resume. So, mention:

- The specific position you’re applying for – Bank Teller

- A short, punchy summary of your most notable experiences achievements

The Body

Once you’ve got the hiring manager hooked with your opener, you can go deeper into the rest of your work history and background. Some of the points you can mention here are:

- Why you want to work for this specific bank

- Anything you know about the bank’s culture

- What are your most notable and how do they relate to this job

- If you’ve worked in other banks or similar positions

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragrpah

- Thank the hiring manager for their time

- Finish with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “Sincerely” or “Best regards”.

Creating a job-winning cover letter can be a challenging craft. But don’t worry, you can rely on our how to write a cover letter for guidance.

Key Takeaways

Congrats!

You now have the knowledge and tools to create a job-winning bank teller resume.

Let’s quickly recap everything we’ve covered:

- Choose the correct format based on your specific circumstances. Prioritize a reverse-chronological format, and follow the best layout practices to keep everything clear and concise

- Use a resume summary or objective to hook the reader

- Talk about your most notable achievements, instead of your daily duties

- Match your bank teller resume with a convincing cover letter